- The plastics industry requires a paradigm shift towards an absolute decoupling of materials consumption from growth of the economy if it is to achieve sustainability targets.

“This shift, a term we call the materials transition, is the process through which we account for – and seek to minimise – the costs of extracting and disposing of raw materials consumed in the global economy. The materials transition is driven by societal concern, regulatory interventions and technological innovation,” said Guy Bailey, Wood Mackenzie Head of Intermediates and Applications.

If all plastic packaging companies put the materials transition at the heart of their sustainability strategies, what would this mean in terms of plastic production and waste generation?

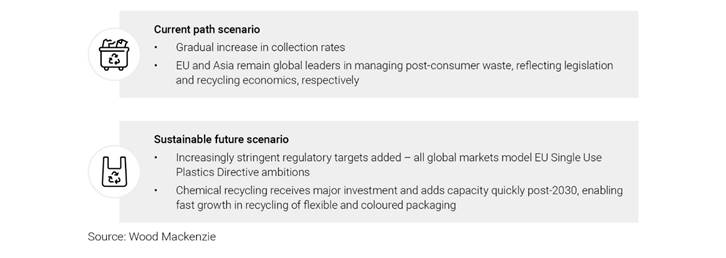

Wood Mackenzie ran two scenarios focused on the major packaging polymers – polyethylene (PE), polypropylene (PP) and polyethylene terephthalate (PET) – to answer this question. A ‘Current Path’ scenario represents the world if it continues as it is today, while a ‘Sustainable Future’ scenario sees more stringent legislation implemented to incentivise companies to be ambitious.

Under Wood Mackenzie’s ‘Current Path’ scenario, the global recycling rate for the selected polymers more than doubles between now and 2040, rising from 17% to 38% of polymer produced for packaging applications.

Under Wood Mackenzie’s ‘Sustainable Future’ scenario, there’s a significant increase in volumes of packaging going through mechanical recycling processes, and significant investment in chemical recycling technologies and capacities. Faster growth in the recycling of flexible, multi-material and coloured packaging follows.

The cumulative impact of these changes is another near doubling of the recycling rate for the observed packaging polymers, rising to approximately 67%. In 2040 alone, this results in an additional 53 million tonnes of packaging plastic prevented from going into landfill, energy recovery or unmanaged waste streams in comparison to the ‘Current Path’ scenario. Cumulatively, from 2020 to 2040, this rises to 382 million tonnes.

“It’s clear to see that chemical recycling has the potential to significantly increase recycling levels. However, the impact of this on the value chain will depend on how circular the recycling chain is. For instance, how much recycled plastic is ‘downcycled’ into non-circular products – such as reclaimed plastic bottles recycled into polyester fibres – and the precise split between recycling routes,” added Bailey.

According to Wood Mackenzie’s analysis, if the industry focuses on maximum value retention by eliminating downcycling, and chemical recycling hugely increases the recycling potential of polyethylene and polypropylene applications, we would see:

- 25 million tonnes of recyclate going back into the polymer stream, displacing virgin polymer demand

- 10 million tonnes equivalent going back into the value stream at the monomer level, displacing the need for ‘virgin’ feedstocks

- 60 million tonnes equivalent at the feedstock level, displacing demand for oil and gas inputs

In total, 95 million tonnes of displaced demand across the value chain would represent a reduction of around 1.5% in global oil demand by 2040. However, the impact on the petrochemical feedstock sector is far more significant, equating to the loss of all petrochemical feedstock demand growth from 2032 in our base case outlook.

“These changes will add to pressure on an already challenged refining sector and pose searching questions about which assets will be most robust to these changes. The most competitive and integrated sites in the future may need to incorporate refining, petrochemical production, waste collection, sorting and chemical recycling hubs.

“Looking to 2050 and beyond, we might see an even more radically changed environment. Further gains in recycling through new technologies. Competition from new materials, such as bio-polymers. Changing consumer trends, with rampant e-commerce supported by increasingly durable packaging applications. All of this could lead to a world where packaging doesn’t require any net new inputs from the energy and petrochemical sectors,” said Bailey.

Wood Mackenzie’s two scenarios illustrate the extent to which decision makers can alter the current trajectory to achieve growth that satisfies society’s demands without further stressing the environment.

“As in other sectors, the packaging industry – and the industries that support it – will need to navigate a complex mix of regulatory interventions and technological investments to thrive in the materials transition,” added Bailey.

Author: GBA News Desk

Source: Woodmac