- Chinese panel maker JinkoSolar shipped photovoltaic products with an aggregate capacity of 25,242MW in the past fiscal year, according to the financial results published by the company.

- Solar modules accounted for a good 22.2GW of total shipments, which is an increase of more than 18% in sales, compared to 2020.

Overall, the company’s sales increased by 16.2% to $6.41 billion and the net result more than doubled, to $113.1 million.

JinkoSolar CEO, Xiande Li, said 2021 was a challenging year due to the well-known global supply chain issues. “Thanks to our competitive advantages in supply chain management and [our]global network, we were able to respond quickly to supply chain volatility and logistical challenges,” he added.

In addition, JinkoSolar has further improved its internal production capacities in order to reduce costs and better hedge against risks in deliveries. “As a result, our deliveries, sales, and profitability increased significantly in the fourth quarter of 2021, compared to the previous quarter,” Li explained.

Related news: JinkoSolar was the biggest exporter to Kenya in 2021

Several milestones were also reached in the current fiscal year. The most important operating subsidiary, Jiangxi Jinko, is now successfully listed on the Shanghai Stock Exchange Science and Technology Innovation Board. This has brought JinkoSolar revenues of RMB10 billion ($1.56 billion), which will mainly go towards accelerating technology advancement and business expansion.

Moreover, the manufacturer forecasts another significant increase in demand for decentralized photovoltaic solutions. “In China, where full-year 2021 installation reached 55GW, distributed generation accounted for more than half of the new installations, due to its higher [financial]yield,” Li continued.

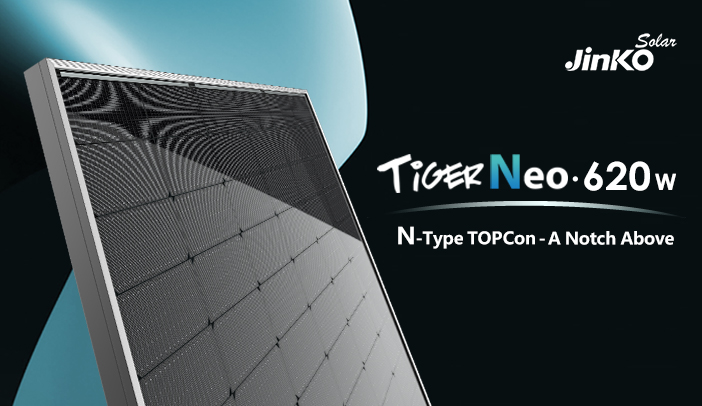

JinkoSolar also said that the switch from p-type to n-type solar modules has also paid off as it is seeing growing global demand for its high-efficiency Tiger Neo modules. “We will expand the leadership of our n-type modules in both domestic and overseas markets. In the first quarter of 2022, we have a capacity of around 16GW for n-type cells in operation and are currently expanding our production capacity continuously,” said Li. “As the integrated capacity structure keeps improving, our integrated costs are expected to decrease further.”

JinkoSolar also revealed that it started production at its new wafer factory in Vietnam in the first quarter, which has an annual production capacity of almost 7GW. “This nearly-7 GW of the integrated overseas monocrystalline wafer, cell, and module manufacturing capacity greatly enhances our global supply chain advantage. At the same time, we have strategically worked with our supply chain partners to combine our complementary resources and build integrated industrial ecosystems,” Li said.

Outlook

JinkoSolar also dared to provide an outlook for the current fiscal year, noting that it is still characterized by some uncertainties regarding end-customer demand and delivery plans, emphasized the management board.

For the first quarter, the module maker is targeting sales of between 7.5 and 8.0GW and, for the full year 2022, JinkoSolar expects to ship between 35 and 40GW of PV products.

In addition, its production capacities should be further expanded. For monocrystalline wafers, annual capacity should reach 50GW by the end of the year, and that for solar cells should grow to 40GW, with 16.9GW being intended for the production of n-type solar cells. The annual production capacity for solar modules should top 60GW by the end of the year.

Author: Sandra Enkhardt

This article was originally published in pv magazine and is republished with permission.