- South Africa will extend the first phase of its carbon tax plan by three years.

- The carbon tax rate in the country increased from R134 to R144 per tonne of carbon dioxide equivalent, effective from 1 January 2022, which will now hold until 2025.

- The transitional support measures afforded to companies in the first phase, such as significant tax‐ free allowances and revenue‐recycling measures, will also continue over the extended period.

The first phase of the carbon tax will be extended by three years for the period 1 January 2023 to 31 December 2025 the Treasury has announced in their Budget Review released yesterday. They added that the transitional support measures afforded to companies in the first phase, such as significant tax‐ free allowances and revenue‐recycling measures, will also continue over this period, alongside adjustments outlined below.

The main proposals include:

- Extending the energy‐efficiency‐savings tax incentive from 1 January 2023 to 31 December 2025.

- Extending the electricity price neutrality commitment until 31 December 2025. The electricity‐related deduction will be limited to the carbon tax liability of fuel combustion emissions of electricity generators, and will not be offset against the total carbon tax liability.

- Adjusting the threshold for the maximum trade exposure allowance from 30 per cent to 50 per cent from 1 January 2023. Updated sectors and allowances will be published for public consultation.

- Penalising emissions exceeding mandatory carbon budgets. The mandatory carbon budgeting system comes into effect on 1 January 2023, at which time the carbon budget allowance of 5 per cent will fall away. To address concerns about double penalties for companies under the carbon tax and carbon budgets, it is proposed that a higher carbon tax rate of R640 per tonne of carbon dioxide equivalent will apply to greenhouse gas emissions exceeding the carbon budget. These amendments will be legislated once the Climate Change Bill is enacted.

Related news: South Africa’s Treasury is considering reducing or eliminating guarantees for REIPPPP Projects

Eskom breathes a sigh of relief

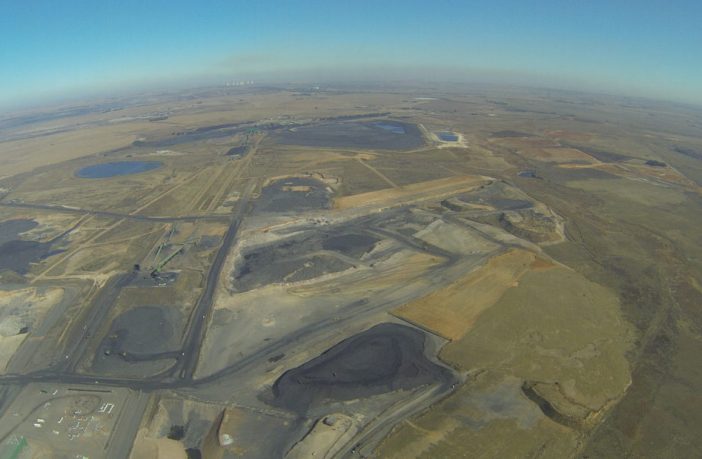

Eskom, South Africa’s state-owned energy utility, has been called the world’s worst polluting power company and Mpumalanga province, where a majority of the Eskom stations are located, the world’s largest air pollution hotspot.

Eskom has estimated an annual carbon-tax bill of around R11.5 billion when exemptions run out at what was supposed to be the start of the program’s planned second phase in 2023. The state owned energy utility has applied to the country’s regulator, Nersa, for a 20.5% increase in electricity tariffs citing carbon tax as one of the reasons for the massive hike request. Read more

Other environment related proposals communicated by National Treasury

- A vehicle-emissions tax rate

- A levy on incandescent light bulbs will be increased

- Measures to regulate electricity-intensive crypto mining, which is environmentally harmful, are being considered.

- A plastic bag levy to be increased by 12% and the government will investigate plastic tax and a duty on single‐use plastics.

- A carbon budgeting system will become mandatory from Jan. 1 and emissions that exceed the budget will be penalized.

- A carbon offset allowance will be increased by 5% from January 2026 to encourage investments in such projects.

Link to the full Budget Review HERE

Author: Bryan Groenendaal