- UK Climate Investments (UKCI) has committed £15 million (approximately ZAR 315 million) of follow-on funding to support Revego Africa Energy Limited’s (‘Revego’) long-term growth and mobilise further private finance flows in support of South Africa’s clean energy transition.

- UKCI is a joint venture between the Green Investment Group and the UK Government’s Department for Business, Energy and Industrial Strategy.

- UKCI forms part of the UK aid funded International Climate Finance.

- UKCI is managed by Macquarie Infrastructure and Real Assets, the world’s largest infrastructure manager.

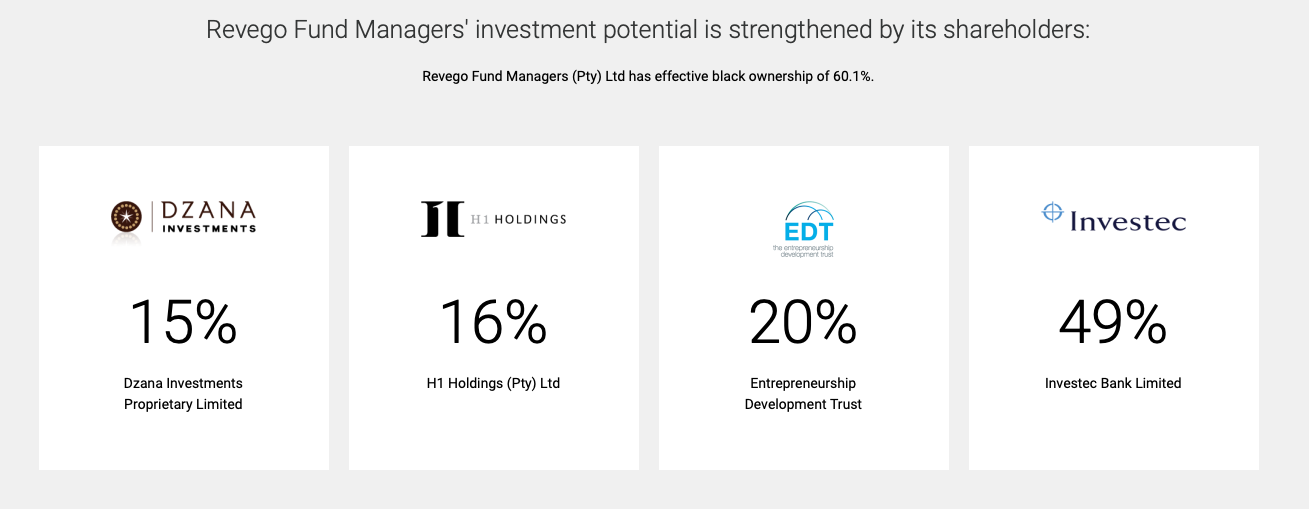

Working alongside Investec Bank Limited as well as Eskom Pension and Provident Fund, UK Climate Investments made an initial commitment of ZAR 500 million (approximately £25 million) earlier this year to help establish Africa’s first dedicated renewable energy yieldco, managed by majority black-owned fund manager Revego Fund Managers.

UK Climate Investment’s additional commitment will support the further growth of the yieldco as it scales up with a view to listing in the public market in due course and further reduce emissions.

Revego helps complete the investment ecosystem for new clean electricity generation capacity by acquiring equity in operational renewable energy projects across South Africa. This helps developers unlock and subsequently recycle capital into new electricity generation and capacity projects, whilst also providing an attractive, green asset class for institutional investors.

Revego’s initial portfolio contains stakes in six projects across South Africa representing a combined installed capacity of 605 MW – enough to provide clean, affordable, and reliable electricity to the equivalent of approximately 200,000 homes. With this additional funding and sustained backing from UK Climate Investments, Revego’s portfolio is expected to grow at pace over the coming 12-18 months as it pursues an attractive pipeline of investment opportunities across the region.

UK Climate Investments is a joint venture between Macquarie’s Green Investment Group and the UK Government’s Department for Business, Energy and Industrial Strategy, which invests UK International Climate Finance to help developing economies tackle climate change and promote clean, resilient and inclusive growth. UK Climate Investment’s latest investment follows a recent commitment made by the governments of South Africa, France, Germany, the United Kingdom and United States, along with the European Union, to mobilise an initial commitment of $US8.5 million to support South Africa’s decarbonisation efforts

“UKCI is delighted to commit this increased level of support to Revego as it actively develops and grows its portfolio of high-quality assets under management,” said Richard Abel, Managing Director, UK Climate Investments.

Author: GBA News Desk