- In April this year, South Africa’s National Treasury announced an R254 billion Eskom Debt Relief Bill (bailout).

- They explained the terms of the bill are aimed at strengthening the utility’s balance sheet, enabling it to restructure and undertake the investment and maintenance needed to support the security of the electricity supply.

- Debt relief can only be used to settle debt and interest payments.

- Eskom’s debt has risen to R439 billion, up 10% year on year.

- The utility is effectively paying interest on its interest.

- By 2026, taxpayers’ money nearing R495 billion or more in Eskom bailouts. Read more

The key features of the taxpayer bailout arrangement include government providing Eskom with advances of R78 billion in 2023/24, R66 billion in 2024/25 and R40 billion in 2025/26. These advances, which have started, will cover capital and interest payments as they fall due and may only be used for that purpose. In 2025/26, the government will directly take over up to R70 billion of Eskom’s loan portfolio.

Now a major shareholder of Eskom, the Treasury has appointed an international consortium with extensive experience in the operations of coal-fired power stations to review all plants in Eskom’s coal fleet and advice on operational improvements back in March.

The review was scheduled to conclude by mid-2023. Eskom is required to implement the operational recommendations emanating from this independent assessment. This will include a determination of which plants can be resuscitated to the original equipment manufacturers’ standards, following which Eskom must concession all these power stations with clear targets for the electricity availability factor and operations. Treasury has declined to reply to our request on the status of the report.

This week Eskom has announced stage 5 blackouts. Breakdowns are currently at 16 572MW of generating capacity while the capacity out of service for planned maintenance is 6 287MW.

Image credit: Eskom

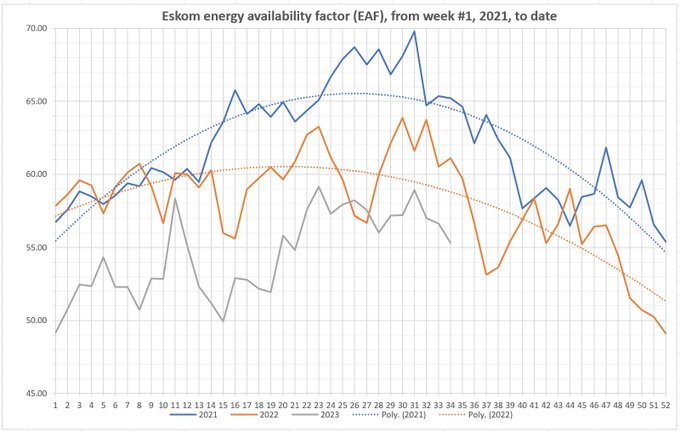

Respected energy analysts, Chris Yelland from EE Business Intelligence, explains that graphs above show Eskom energy availability factor (EAF) from week 1, 2021, to week 34, 2023. EAF for week 34, 2023, is 55.32%, compared to 61.10% for week 34, 2022. The EAF for the 2023 calendar year to date is 54.52%, compared to 59.78% for the same period in 2022

History tells us that the country can expect higher stages of loadshedding leading into year end.

Author: Bryan Groenendaal