- SolarAfrica Energy sees wheeling into South Africa’s Commercial & Industrial (C&I) market as delivering the bulk of their revenue over the next three to four years.

- While the solar company has achieved a great deal in the solar PV rooftop space for the C&I market in South Africa, the sheer scale offered by wheeling means the company will be stepping up a level when it comes to how much electricity it can offer to clients.

- This is supported by African Infrastructure Investment Managers’ (AIIM) announcement to commit R1.25 billion in equity and shareholder funding to SolarAfrica in support of its contracted pipeline.

SolarAfrica Energy and Starsight Energy last week announced their pending merger – which should be finalised in the next three to six months. This creates a solar player across South, West and East Africa, set on providing renewable energy and energy-efficient solutions to sub-Saharan Africa’s C&I market.

The investment supports the provision of green energy and helps create certainty of pricing for large C&I customers in the South African wheeling space.

As Thor Corry, AIIM Investment Director, said, the newly merged company would be perfectly positioned to help solve South Africa’s loadshedding issues. “SolarAfrica is already a significant provider of energy in South Africa, but will build on this heritage, constructing new utility-scale generation facilities and wheeling electricity over the country’s existing power grid,” said Corry.

Ten 100MW solar farms for wheeling to C&I applications

When it comes to developing electricity policy in South Africa, Presidential pronouncements are usually followed by a scramble by the Department of Mineral Resources and Energy, NERSA and the IPP Office to develop supporting policy.

Speaking to ESI Africa, David McDonald, SolarAfrica Energy Managing Director, said they decided to pursue wheeling after the increased self-generation threshold announcement was made in June 2021 because Eskom already had policies in place and had set precedent for smaller wheeling transactions.

Their biggest obstacles then became obtaining a clean Environmental Impact Assessment and picking a location with suitable grid capacity. SolarAfrica had picked up the right to build solar farms in the Northern Cape Province from a company which had made an unsuccessful bid into the Renewable Energy Independent Power Producers Programme (REIPPPP).

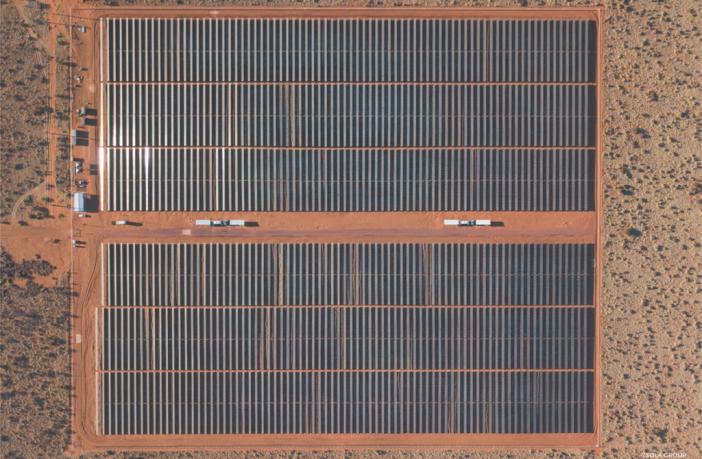

SolarAfrica Energy will now develop ten adjacent 100MW solar farms on land they are leasing in the Northern Cape. Construction is expected to start in the first quarter of 2023, with the commissioning of the first solar farms scheduled for the first quarter of 2024.

They will erect multiple farms in parallel as the wheeling demand grows. “The timeline will be driven by the market… Every six months, another 100MW farm will come online,” McDonald predicts.

SolarAfrica will also build a very necessary substation adjacent to the solar farms. It will connect to an Eskom overhead line between two existing substations, neither of which has additional capacity to handle the solar farms.

The substation will be built in two stages as the electricity being evacuated onto the grid ramps up. Once completed, the substation will be handed over to Eskom because SolarAfrica does not have either a transmission or distribution licence. “I suppose it does incentivise Eskom to work with us.”

“The substation is ultimately being built in two pieces. The smallest building block that Eskom wants us to use is 500MVA. So we’re going to bring on that portion first, and when we move beyond that mark in PV, we’ll bring on the other half,” explained McDonald.

Pricing

SolarAfrica will rely heavily on NERSA regulations to help set their eventual pricing model for their wheeling customers, who will pay a transparent tariff to Eskom for the use of their transmission lines. “It is a standard pricing model, it doesn’t link to the size of the farms. We are building the farms in blocks and selling [electricity]to multiple parties,” he explained.

While they do have to consider transmission cost and factor in building the substation, McDonald thinks both Nersa and Eskom are transparent enough in how they set tariffs and fees that end users will know exactly what they are in for.

SolarAfrica has identified new customers for the proposed pipeline, with 110MW already signed for. “So that will take the bulk of the first lot, and we continue negotiating with other parties. Some of the parties are taking a staggered approach. They don’t need everything up front, so 10MW for now, and next year, maybe 20MW. “We are feeling very bullish about being able to fulfil the offering,” said McDonald.

Policy and infrastructure development is key

The SolarAfrica MD says he sees several players coming into the wheeling space, which will stay positive as long as policy development and strong investment into expanding and strengthening South Africa’s T&D infrastructure are maintained.

While he doesn’t think trading into the Southern African Power Pool will happen in the short term, McDonald sees it as an eventuality. For now, “the market is big enough in South Africa that we don’t have to look for offtakers outside of South African borders,” he said.

Judging by where the EU electricity market is going, he thinks multiple IPPs and traders will bring price tension and customer optionality. The local market’s biggest problems will be developing responsive policies and keeping corruption at bay as private sector generation is brought into the mix.

“I think we will see Eskom becoming a wires business. The unbundling takes the money out of the generation, which is the biggest point of corruption,” said McDonald.

The original EIA for the farms, done under a failed Risk Mitigation Programme bid, got approval for a storage element they may eventually use. “We don’t see the value for the end user yet. But you never know what could happen over the next two years,” said McDonald

Author: Theresa Smith

Theresa Smith is a conference producer for Vuka Group.

This article was originally published on ESI Africa and is republished with permission with minor editorial changes.