- In December, Sasol shareholders were informed that the annual general meeting (AGM) which had been convened to take place on 17 November 2023 at Sasol Place, could not take place due to disruption by protestors.

- The AGM took place virtually yesterday after the board went to great pains by publishing a letter in a paid media campaign to try to convince shareholders and the South African public at large they are not one of the worlds biggest air polluters.

- The letter, from Sasol’s CEO Fleetwood Grobler, is addressed to “stakeholders” and titled “Balancing People, Planet, Profit on our pathway to Net Zero”, calls out civil rights groups and share activists without addressing their concerns. Read more

Related news: SASOL AGM decends into chaos over flawed climate goals – cancelled

Total annual compensation for outgoing CEO, Fleetwood Grobler, was R41million for the year to June 2023. Image credit: Freddy Mavunda

Institutional investors pulling out

Leading up to the botched AGM in November, Sasol also publicly criticised Old Mutual Investment Group (OMIG), one of its biggest shareholders, for pre-declaring its intention to vote against Sasol’s 2023 “say on climate” resolution. Sasol stated that OMIG “appears to have placed significant reliance on the Just Share report without proper consideration and/or recognition of any of Sasol’s recent disclosures and assertions made in response, which point to factual inaccuracies contained in Just Share’s report”.

Ninety One has also pre-declared its intention to vote against Sasol’s climate change resolution. Although Ninety One’s concerns are similar to those of Just Share and OMIG, Sasol has not alleged that Ninety One placed improper reliance on Just Share’s briefing in making its decision not to support Sasol’s climate plans.

Related news: Sasol reaches new frontiers in air pollution – pumps out more emissions each year than entire countries like Portugal

No one believes them

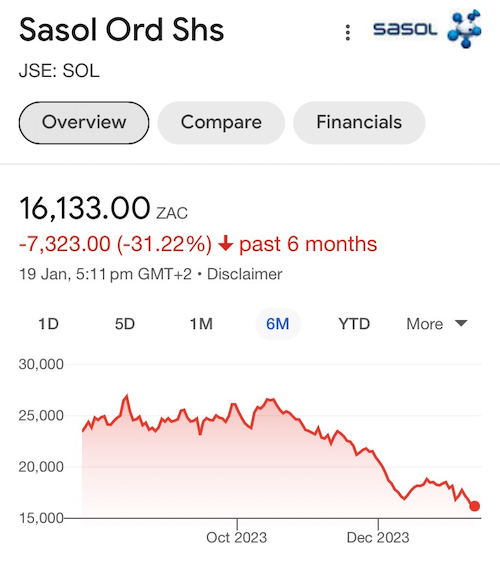

Yesterday, the Sasol board went to great lengths to try to convince and reassure investors about their commitment to sustainable environmental practices and broader plan to reduce thier carbon emmissions, pushing their resolutions through, but the market is not buying it. There has been too many contradictory statements and double downs on their commitments. Sasol share price is in rapid decline, losing just over 31% in the last 6 months alone despite a bouyant oil price.

Author: Bryan Groenendaal

1 Comment

Pingback: Sasol avoids climate protestors with virtual AGM as share price continues to tumble - Just Share