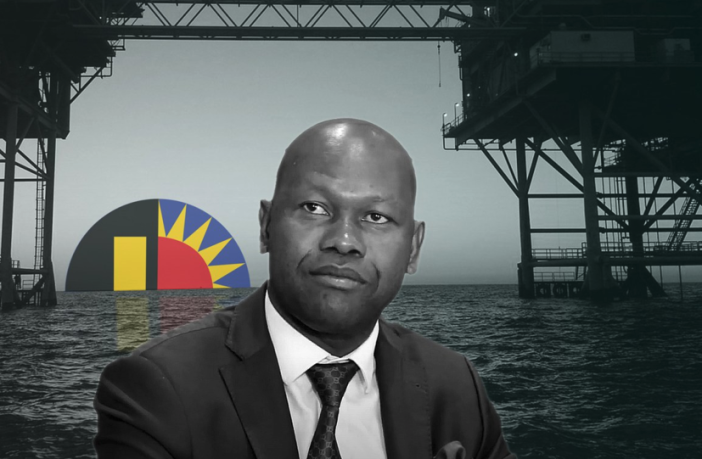

- PetroSA has chosen Equator Holdings, run by notorious political operator Lawrence Mulaudzi, to bankroll exploration of its offshore gas reserves and rebuild critical gas infrastructure.

- The Limpopo businessman was mentioned 176 times in the Mpati Commission report into malfeasance at the Public Investment Corporation and has been accused of channelling money to ANC and EFF politicians.

- The projects awarded to Equator are critical for government’s dream of developing an offshore gas industry, but it is unclear where Mulaudzi, who previously had his Bentley repossessed, will find the billions PetroSA needs to rebuild gas infrastructure and drill wells.

On 11 December, the Petroleum, Oil and Gas Corporation of South Africa (PetroSA) held a two-hour press conference to try to defend its R3.8-billion deal with Russia’s Gazprombank.

If the experience was bruising it did not show.

Just hours later, the same officials held a private signing ceremony to cement a deal that is far bigger and more dubious with politically-connected businessman Lawrence Mulaudzi.

Mulaudzi was a key character in the Mpati Commission’s investigation into corruption and malfeasance at the Public Investment Corporation (PIC) – his name is mentioned 176 times in the final report. He has also been accused of channelling money to a company linked to EFF deputy president Floyd Shivambu, and a trust linked to former ANC treasurer Zweli Mkhize.

The deal quietly inked on 11 December gives Mulaudzi’s company, Equator Holdings, the mandate to fund and rebuild critical gas infrastructure that is at the heart of government’s multi-billion-rand gamble on gas.

This includes refurbishing the FA offshore platform – which connects offshore gas to pipelines that bring it onshore – and the gas portion of PetroSA’s Mossel Bay refinery.

PetroSA confirmed that in each of these cases, Equator will both fund and execute the projects.

It is unclear where Equator will find the money. Mulaudzi’s own finances are precarious: Absa previously seized his Bentley and last year obtained two debt judgments against him totalling R2.8-million; his former landlord Aucap tried to repossess his Camps Bay home over unpaid rent.

But Mulaudzi brushed aside all criticism: “We are … pleased as a company to enter into this partnership with PetroSA which will provide security of gas supply and unlock infrastructure bottlenecks in the energy space for South African economy,” he said in a two-page letter, sent on behalf of the company.

“Although we cannot disclose the details of the transactions as we are bound by legal confidentiality provisions, we can confidently state that Equator Holding complied with PetroSA requirements… We have every intention to deliver, and we will!”

Full marks for confidence, but a closer look at the deal suggests that PetroSA appointed Equator without any evidence that it had either the money or technical skills for a project of this scale, raising serious doubts about the probity of the process.

The first tender

In January last year, PetroSA issued three tenders: one was to restart the gas-to-liquids (GTL) refinery in Mossel Bay, which was eventually awarded to Gazprombank Africa.

The other two tenders focused on PetroSA’s offshore gas fields, which until 2020 provided the feedstock for the GTL refinery.

RFP 0003 was to appoint a technical partner who could restart the wells and drill new ones in the turbulent oceans off the Eastern Cape, while RFP 0004 was a funding only version of the same project.

By mid-2023, PetroSA had selected preferred bidders for the two overlapping tenders: Theza Oil & Gas wanted to drill the wells using its own funders (RFP 0003), while Equator Holdings – Mulaudzi’s company – wanted to fund the deal (RFP 0004), which PetroSA estimated could cost $1.2-billion (R21.6-billion).

It is not clear how Equator qualified. The tender was explicit that any successful bidder “must be an established player, or credible financial institution” to avoid being eliminated. Equator was neither.

The company was registered in 2018, but has no website and no track record we could find in the financial sector or energy space; to the extent it operates, it appears to do so from Mulaudzi’s Sandhurst home.

In fact, Equator had submitted a bid for RFP 0001, the tender that Gazprombank bid for and won, but it scored 0 out of 100 and was disqualified because the “[a]uthenticity of entity could not be established”.

Another “elimination criteria” of RFP 0004 was that bidders had to demonstrate “sufficient funding to support [the]proposal”. This, the tender suggested, should be in the form of an “indicative term sheet or letter, outlining at least success fee, interest rate, duration, maximum funding and any other material conditions”.

Equator had secured a letter of intent from the Industrial Development Corporation (IDC) suggesting it may be willing to invest up to R1-billion in the project – once it had evaluated the project and done a due diligence. But this is far more preliminary than the term sheet the tender required.

A spokesperson for the IDC confirmed that “[t]he IDC did not issue a term sheet to … Equator Holdings.”

Unfazed, PetroSA selected Equator as the preferred bidder to bankroll the R21.6-billion expansion of its upstream gas assets.

“The Evaluation Team evaluated the bids in accordance with the evaluation criteria that was published, and points were allocated accordingly. The Evaluation Team subsequently recommended Equator Holdings as the preferred partner,” PetroSA told us in a written response that failed to answer questions about the seemingly glaring gaps in the Mulaudzi bid.

Equator did not want to discuss specifics but told us: “We confirm that prior to the award, we submitted a detailed proposal to PetroSA, which we believe complied with all the set requirements. We also provided documents that were required in this bid.”

The ‘arranged marriage’

Predictably, PetroSA now had a problem. Two bidders had been selected to fund the same projects: Theza, which would execute and fund the project, and Equator, which would only fund it.

Author: Susan Comrie

This is an extract from a main article with more information Susan Comrie for the amaBhungane Centre for Investigative Journalism.

Read the rest of this exclusive story from the amaBhungane Centre for Investigative Journalism HERE