- Wood Mackenzie has released the Corporate oil and gas: 5 things to look for in 2023 reports today.

- Key themes to watch for include operators’ shifting capital allocation dynamics, growing momentum in decarbonisation and renewable energy and continued reconfiguring of oil and gas projects and portfolios.

Country risk and cost inflation have also risen to the top of corporate agendas, as governments mull windfall taxes and the supply chain looks to capture higher margins.

Capital allocation will shift as deleveraging slows

The oil and gas sector will largely complete the deleveraging phase of the current cycle in 2023. An elite group of companies will aim for net debt zero to bulletproof balance sheets. More highly geared players will also reach their optimal state, particularly if oil remains above US$80/bbl. More operators will shift towards a dual capital allocation strategy: to invest or return cash to shareholders.

“We could see a record year for buybacks in 2023,” said Tom Ellacott, senior vice president of corporate oil and gas for Wood Mackenzie. “We are forecasting that 54 of the world’s largest oil and gas companies will generate US$400 billion in surplus cash flow (post dividends but pre buybacks) at US$95/bbl. With less capital going into debt reduction, buybacks could surpass 2022’s record of around US$110 billion”.

More players will also weigh up expanding investment while sticking with disciplined screening criteria.

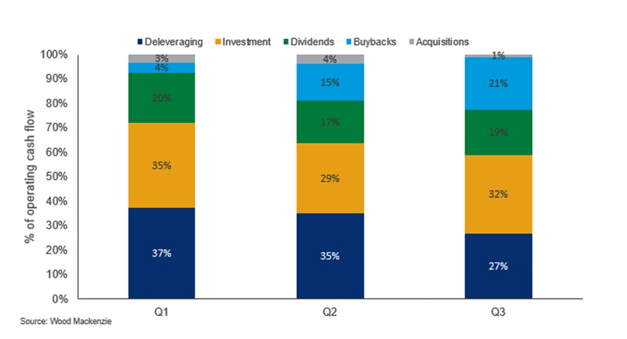

Ellacott expands “The Majors and US Independents have re-invested just 27% and 35%, respectively, of their year-to-date operating cash flow in 2022. Most will look to increase re-investment rates to maintain or grow oil and gas production, accelerate decarbonisation and expand into renewable energy. More cash-funded M&A also seems likely.”

He concludes that “Tight oil leaders are in pole position to shift gears to high single-digit growth among the International Oil Companies. For the National Oil Companies (NOCs), the focus on securing new supply will take centre stage with rising investment in delivering new oil, gas and LNG supply. “

US operators: Deleveraging down, distributions up during 2022

2023 could be an inflection point on the path to Upstream 2.0

Decarbonising oil and gas portfolios and developing resources responsibly will be a top priority. But activity levels must increase if future supply shocks are to be avoided.

Fraser McKay, Head of Upstream Analysis at Wood Mackenzie, elaborated: “Upstream development spend needs to rise. Not by as much as most observers think; the inefficiency of the early 2010s is neither welcome nor required. But where investment is deployed and by whom will be a topic of much debate in 2023”

The number of major projects (larger than 50 million boe in size) likely to take Final Investment Decisions in 2023 will remain flat, with around 30 projects proceeding. “Operators will seek the sweet spot where social licence and fiscal incentives align with advantaged barrels,” said McKay.

Inflation and execution risks will continue to rise in 2023, with the supply chain reluctant to add capacity until the service sector is convinced the uptick in demand is here to stay. Capacity will at best creep upwards, with most additions at the high-tech end of the market. More efficient? Yes. Cheaper? No.

Governments and NOCs in the main producing countries will try to marry low-carbon credentials with increasing upstream investment in 2023. International operators will need to demonstrate and disclose further emissions reductions. Spend on decarbonisation will increase with a focus on methane emissions reduction and Carbon Capture and Storage (CCS).

McKay continued: “Operators will design upstream projects with low carbon credentials in mind. Developments will become ever more entwined with renewables, low-carbon hydrogen and offsetting projects to balance emissions. By the end of 2023, it will be extremely hard for mainstream operators to sanction projects without emissions mitigation plans. It could be an inflection point on the path to Upstream 2.0.”

Momentum will build in renewable energy

The Majors will enter a different growth phase in low-carbon energy, with tailwinds from growing and consistent government support (such as the US Inflation Reduction Act and RepowerEU) offset by rising competition, supply chain challenges, permitting and grid-access constraints.

“The Euro Majors will once again set the pace,” said Ellacott. “Leaders such as TotalEnergies, Shell and BP may even invest more in renewables than some big traditional utilities. The Euro Majors will scale up M&A with the possibility of transformational transactions in power.”

The report also notes that the Euro Majors will place more emphasis on project execution in 2023 as their renewables portfolios mature. The risk of delays and cost overruns will grow.

But activity in renewable energy will broaden out to more oil and gas companies.

Ellacott expands “We expect the US Majors to play a more active role in low carbon as their budgets increase and business development in CCS, renewable hydrogen and low emissions fuels accelerates. The NOCs’ energy transition models will also take shape in 2023, as they did for Euro Majors in the 2010s.”

The report also examines how oil and gas companies will diversify geographically, into gas and across different asset classes to broaden their risk exposure.

Read the full report HERE

Author: Bryan Groenendaal

Source: Woodmac