- Kampala – The StopEACOP coalition welcomes the recent announcement by Sumitomo Mitsui Financial Group (SMBC Group) stating its current non-involvement in the East African crude oil pipeline project (EACOP).

- Since 2017, Sumitomo Mitsui Banking Corporation (SMBC), a subsidiary of SMBC Group, has reportedly acted as one of three financial advisors for the EACOP project and joint lead arrangers for the project’s $2-3 billion loan.

- The bank’s statement confirming they are no longer involved in the project after years of involvement is a particularly stark warning that the EACOP project is too risky, and financial institutions should disassociate themselves from this controversial pipeline.

This news comes only days after Standard Chartered Bank declared it would not finance the EACOP project. The recent announcements were made amidst mounting criticism from environmental groups and key stakeholders, citing the exacerbation of climate change issues, the potential harm to local wildlife and the loss of livelihoods by frontline communities. Consequently, this project has become a symbol of a globally changing environment and how risky projects like EACOP will continue to be for financial institutions.

While SMBC refrained from disclosing any prior involvement, the bank had not only provided large amounts of funds to TotalEnergies, which is promoting EACOP, but was also serving as a financial advisor on EACOP.

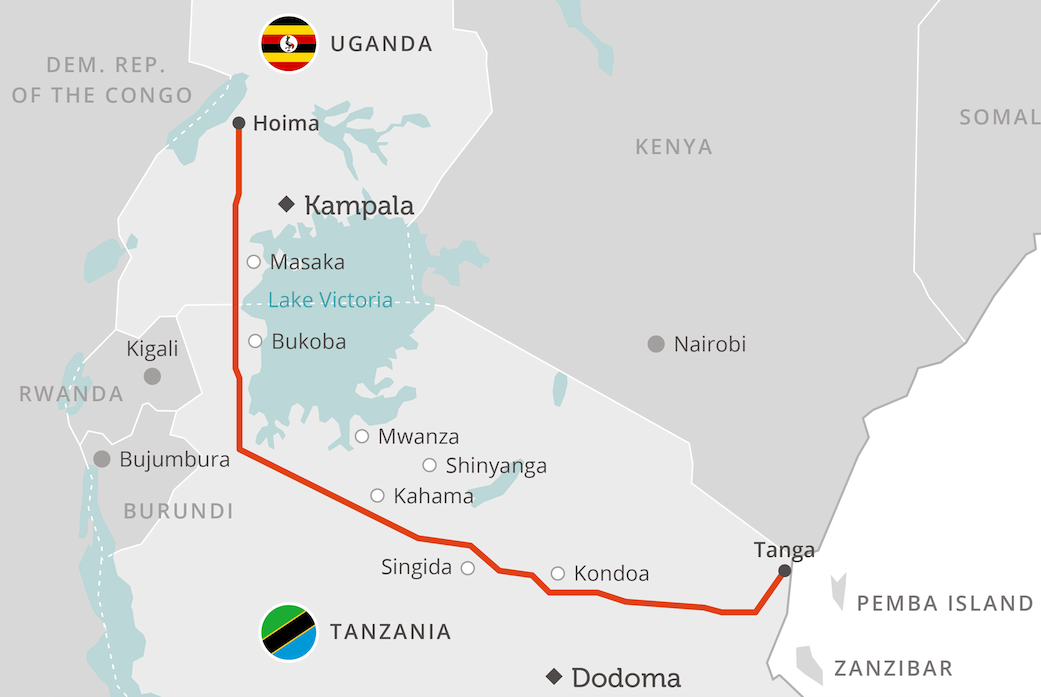

East African Crude Oil Pipeline map. Image credit: EACOP

In light of this development, the StopEACOP coalition urges the other two financial advisors for EACOP, Standard Bank and the International Commercial Bank of China (ICBC), to follow the lead set by SMBC and Standard Chartered to distance themselves from this contentious project publicly. SMBC joins a growing list of banks and insurancefirms that have now publicly withdrawn from this controversial project.

Financial institutions must align their investments and business practices with the urgent global need for sustainable and environmentally responsible solutions – investments that avoid or minimise negative impacts on frontline communities. The science is clear that urgently phasing out fossil fuels is needed to keep warming below 1.5°C; ongoing support and investment in fossil fuels contribute to the climate crisis.

The StopEACOP coalition will continue to monitor and campaign against the involvement of financial institutions in the EACOP project, advocating for greater transparency and a shift towards renewable energy alternatives. By taking a firm stance against environmentally and socially damaging projects, financial institutions can contribute to a more sustainable and just future.

Author: Bryan Groenendaal

Source: StopEACOP