Open-Ed

- South Africa’s Solar Photovoltaic (PV) sector has seen a significant surge in solar panel imports over the last year.

- In the first half of 2023, the country imported about R12 billion ($650 million) worth of solar cells and panels, which is more than double the value of imports for the whole of 2022.

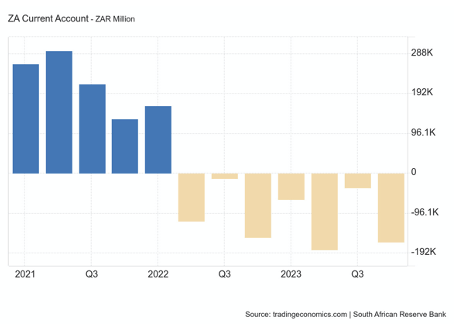

My immediate reaction to the post wasn’t celebratory; instead, it sparked curiosity. I wondered what the impact of the climate change-driven shift from a predominantly domestically sourced coal-based electricity system to one reliant on foreign-manufactured and often foreign-funded renewable energy technology is on South Africa’s balance of payments. This question is particularly pertinent as the country declared a current account deficit for the first time in three years in the last quarter of 2022 and every quarter since and as load shedding continues to ravage the country.

While I don’t have the exact figure on the proportion of domestic versus imported composition of Solar PV hardware investments in the country—including the balance of system components like cables, frames, and inverters—it’s evident from my experience that a majority of these components are sourced from leading global manufacturers in China. The issue of hardware origin doesn’t seem to be a primary concern for many renewable energy developers.

Of equal concern is understanding the origins of capital, the ownership structures, and identifying the private entities that stand to benefit from the growing pressure on South Africa and other countries throughout the continent to “liberalise” or, more accurately, privatise their electricity markets in the pursuit of accelerating renewable energy adoption.

Should South Africa continue to fund its transition to renewable energy predominantly through foreign debt, it risks falling victim to what is commonly referred to as the “double loan” phenomenon. In this scenario, funds are borrowed by a developing nation to construct, for instance, a hydroelectric dam, yet a significant portion, if not all, of the funds are disbursed to Western corporations. Consequently, citizens of developing nations are burdened with both the principal and interest, while the developed world reaps double benefits through profits accrued by multinational corporations engaged in advisory, construction, or import services.

Two notable instances of the double loan concept in practice immediately come to mind. The first example is referenced in “The Lords of Poverty” by historian Graham Hancock, which critically examines the initial five decades of policies by the World Bank, the International Monetary Fund (IMF), and foreign aid in general. Hancock notes, “The World Bank is the first to admit that out of every $10 it receives, around $7 are in fact spent on goods and services from the rich industrialised countries.” In one particular year, Hancock reveals, “British taxpayers provided multilateral aid agencies with £495 million ($621 million); however, British firms were awarded contracts worth £616 million ($773 million) from the same agencies over the same period.” Hancock wrote that multilateral agencies consistently tend to procure British goods and services equivalent to 120% of Britain’s total multilateral contribution.

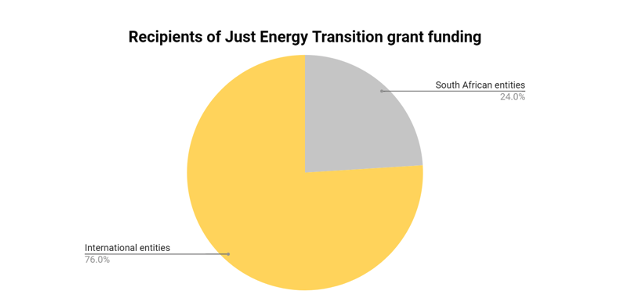

Image credit: Southern Centre for Inequality Studies at the University of the Witwatersrand

The second example, closer to home is the Just Energy Transition Partnership (JETP), introduced amidst great anticipation at COP26 in Glasgow in 2021. This initiative, totaling $8.5 billion (R157 billion), involves contributions from the European Union, Germany, France, the US, and the UK, with later additions from the Netherlands and Denmark to finance South Africa’s energy transition. However, despite much fanfare, the program has faced significant backlash for its allocation of a mere 4% in grant financing, with the bulk of the funding being in the form of concessional loans. Setting the criticism aside on the structure of the program, how the 4% grant was spent was extremely telling.

Researchers from the Southern Centre for Inequality Studies at the University of the Witwatersrand uncovered that for example of the of the total grant amount R1.7 billion is allocated to GIZ and with a further R2 billion being allocated to KfW, both German development entities, constituting more than a third of the total grant pot. Similarly, the researchers found that of the R222 million grant from the US earmarked for consulting and financial advisory service, R145 million is allocated to US firm Deloitte and R58 million to the US Department of Energy’s National Labs. Overall, it was revealed that 76% of the grant amount was allocated to foreign firms with approximately R1.2 billion of the grant financing is earmarked for technical assistance, a practice often criticised for its inefficacy, exorbitant costs, and reliance on foreign “experts”, representing a dated approach to development.

Under the current energy transition pathway South Africa is at risk of falling prey to the infamous World Bank and IMF “structural adjustment playbook” which notoriously prioritises lower-value resource exports and at the expense of industrialisation and sustainable development. This structural dependency phenomenon underpinned by volatile primary commodity dependence and import of high-value products holds true across the continent. In 2020, Africa’s exports totaled $457 billion, largely driven by a handful of commodities with minimal value addition. In contrast, imports soared to $627 billion, consisting predominantly of complex products with substantial value addition. This imbalance creates a structural trade deficit which weakens the value of African currencies and fosters unsustainable external debt across the continent. Presently, there’s a whopping $2 trillion net resource transfer from the Global South to the Global North!

Let’s take a look at some of the world’s poorest countries. By 2020, Niger’s exports were 75% uranium; Mali’s 72% gold; Zambia’s 70% copper; Burundi’s 69% coffee; Malawi’s 55% tobacco; Togo’s 50% cotton and the list goes on.These goods aren’t extracted or produced for local consumption but rather to serve the needs of French nuclear plants, Chinese electronics manufacturers, German supermarkets, British cigarette companies, and American clothing brands. Essentially, these economies have been engineered towards feeding and fueling other societies instead of advancing local development.

A roadmap to African energy sovereignty

Beyond energy access and security, Africa needs to strive towards energy sovereignty. So how can Africa overcome its structural challenges and achieve energy sovereignty in a world where developed nations have trillion dollar subsidies, significantly lower cost of capital and a centuries head start in energy technology? Firstly, energy sovereignty will not happen at individual state levels. The continent needs to come together and reimagine alternative, afrofuturistic energy developmental pathways. Africa needs to develop a homegrown strategic vision for its energy landscape which ensures greater control of its future. This strategic vision can build on work done under Agenda 2063 and African Union’s Action Plan of the Africa Renewable Energy Initiative (AREI). The vision needs to be people centred and framed in terms of African values and social justice. The continent is well placed to transform this vision into reality, given its abundant reserves of green minerals, large tracts of underutilised land, and a youthful, dynamic population. This conversation coincides with the renaissance of Pan-African politics and cooperation.

The concept of a nationalist energy policy is not bold or unique. Take the Inflation Reduction Act (IRA) of the USA as an example. This legislation earmarked close to $783 billion to reduce the nation’s dependency on Chinese clean technology and bolster the domestic industry through a mix of tax incentives, grants, and loan guarantees. This comes after decades of clean technology development market subsidies by the Chinese government.

So what does an inflation reduction act for Africa look like?

In contrast to the current imposed, undemocratic development strategies, there’s a pressing need for a comprehensive Pan-African Strategic Energy Self-Reliance blueprint. This plan should be transparent, incorporate stakeholder engagement and cater to the diverse needs of all African nations, as opposed to the, for example ,selective approaches of the Just Energy Transition Partnerships (JETPs) which are influenced by the geopolitical interests of G7 countries. The program should prioritise domestic energy needs over for example Green Hydrogen for export abroad. Africa’s energy transition process must be measured and above all prioritise economic stability.

Existing global trade agreements do not prioritise Africa’s interests. Market power in the green minerals sector is largely held by manufacturers in developed nations, and in particular China. Similar to OPEC’s role in the petroleum industry over the past century, Africa needs to better organise the green minerals market and establish “green mineral cartels” with greater control over commodity pricing. Furthermore, African governments should reassess exploitative mining agreements and introduce progressive national and local ownership models in these strategic sectors.

The late George Ayittey, founder of the Free Africa Foundation, observed that fifty years after the establishment of the Bank and Fund, “90% of the $12 billion per year in technical assistance was still spent on foreign expertise.” In 1994, Ayittey also highlighted that although 80,000 Bank consultants were working on Africa, “less than .01%” were Africans. To improve the efficacy of multilateral energy development programs, there is a clear imperative to engage more local consultants. Africans are intelligent, Africans are capable. Simultaneously, there is a need for a structured approach to strengthen Pan-African knowledge and educational institutions in order to enhance skills across the private sector, civil society, and governments.

Medium to Long term

The continent needs to formulate forward-looking national and Pan-African energy industrial policies that capitalise on the complementarity of African resources and capabilities. These policies should aim to foster the growth and localization of value addition and manufacturing of clean technology. Initiatives should initially focus on technologically simpler and heavier balance of system components, such as panel frames and lithium carbonate, building on the continent’s mineral comparative advantage. These policies should include;

- Mandatory green mineral beneficiation, for example, Zimbabwe’s lithium ore beneficiation policy which requires all lithium mining ore companies to either develop a local approved processing plant or sell its lithium ore to an approved local processing plant.

- Designated local content (DLC) provisions which mandate cleantech developers to procure a specified percentage of their technology from local manufacturers or producers. For example, India’s local content regulations for its national solar auction which requires cells and modules to be produced domestically. This spurred local manufacturing in the country, with over 11 GW/year of capacity added since 2009 in India, of which 6.8 GW/year were built which were established post-2016.

- Financial subsidies and tax incentives to promote value addition and manufacturing.

- Cleantech hardware (protectionist) tariffs.

- Demand side support through public procurement and the establishment of a conducive enabling environment for the cleantech sector.

- Enhanced intra-Africa trade and South-South cooperation. The African Continental Free Trade Area (AfCFTA) Agreement serves as a promising starting point for this.

- Robust quality assurance systems to help build an attractive “Made in Africa” cleantech brand.

For Africa to achieve energy independence, a substantial amount of capital will need to be mobilised. This endeavour could be advanced by:

- Establishing a common and stable currency.

- Exploring alternative local financing options, such as community savings groups and diaspora remittances.

- The Global North has vastly exceeded its carbon budget and owes the rest of the world a climate debt. Despite the fact that colonial atrocities on the African continent are well documented, very little redress has been made in terms of direct financial compensation to individuals, tribes, or nations. Africa has suffered from decades of colonial pillage and neo-colonial extractivism. The Global North countries need to repay both colonial and climate debts, some which can be channelled towards the energy transition. This is not charity but a responsibility of the transgressors.

- The systematic cancellation of unfair and odious debts, which will deter future unscrupulous lending and promote increased transparency in new financing.

- Blended finance approaches and de-risking mechanisms such as first loss facilities and results-based financing.

- Redirecting fossil fuel subsidies to support the energy transition.

- Reforming imbalanced and unfair international regulations on trade, investment, and technology to grant African countries broader access to critical cleantech “intellectual property”. There is a need for more open-source technology development approaches in the cleantech sector.

- Developing policies which help increase community ownership and participation in the Just Energy Transition.

As an Afrofuturist and Just Energy Transition innovator I am excited about what an alternative energy development pathway could look like for Africa. I look forward to collaborating with like-minded progressive thinkers to help turn this bold vision into a reality.

Author: Kumbirai Makanza

Kumbirai is an Afrofuturist and Just Energy Transition innovator guided by a passion for Africa, its sustainable development and its potential to leapfrog.

Disclaimer: The articles and videos expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Green Building Africa, our staff or our advertisers. The designations employed in this publication and the presentation of material therein do not imply the expression of any opinion whatsoever on the part Green Building Africa concerning the legal status of any country, area or territory or of its authorities.