- South Africa’s state owned and state-run energy utility, Eskom, release their Group annual results for the year ended 31 March 2023.

Main takeaways:

- Generation performance continued to deteriorate, while networks and new build delivered variable performance. Plant availability deteriorated to 56.03% (2022: 62.02%), with unplanned load losses rising to 31.92% (2022: 25.35%) and planned maintenance at 10.39% (2022: 10.23%).

- Loadshedding had to be implemented on 280 days during the past year due to generation supply constraints and shortfall from IPP programmes. 9.9TWh (5%▼) decline in sales volumes across every sector due to Eskom and IPP generation supply constraints, leading to loadshedding and load curtailment.

- Gas turbines produced 4 116GWh (2022: 2 725GWh) at a cost of R29.7 billion (2022: R14.7 billion) for Eskom and IPP OCGTs.

- Arrear municipal debt escalated to R58.5 billion (2022: R44.8 billion).

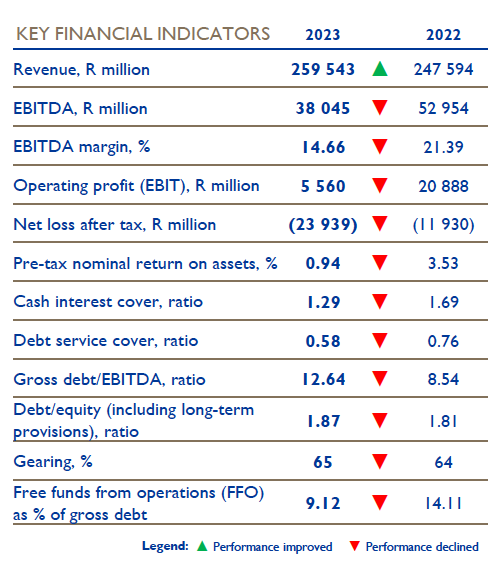

- Net loss after tax worsened to R23.9 billion (2022: R11.9 billion).

Eskom’s generating plant availability reached the lowest levels ever, due to unprecedented levels of unplanned unavailability. A factor that contributed to the supply constraints is the fact that IPP capacity – both renewable and other programmes, such as DMRE’s Risk Mitigation IPP Procurement Programme – has not come online as expected under the IRP 2019, with an energy shortfall of more than 5 100GWh for the year, requiring increased levels of loadshedding and “overproduction” by Eskom and IPP-owned OCGTs of around 2 000GWh for the year.

Additional dispatchable capacity of 4 000MW–6 000MW is required immediately, to support the stability of the power system, create space for maintenance and reduce the need for loadshedding.

Link to the full presentation here: Eskom 2023 Results Presentation_Final

Author: Bryan Groenendaal