- The demand for its shares was so oversubscribed that it ended up selling 4% instead of the initial 2.5% offered.

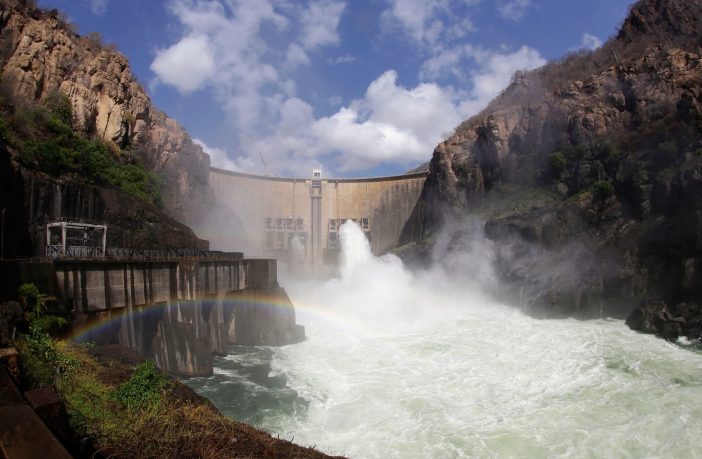

- Hidroelectrica de Cahora Bassa (HCB) is the company which operates the Cahora Bassa dam on the Zambezi in the western Mozambican province of Tete.

- The sale ran from 17 June to 12 July 2019.

HCB chairperson Pedro Couto said at a results ceremony held in Maputo this week that the initial offer was for 686,887,315 shares. But the increased demand meant that the company added a further 412,132,389 shares to the offer. The sale resulted in 16,787 Mozambican citizens and institutions (mostly small scale individual investors) becoming HCB shareholders.

“More than 16,000 Mozambicans throughout the country, from 142 of the 154 districts, and Mozambicans living in the diaspora who met the requirements, have invested in buying HCB shares”, said BVM chairperson Salim Vala. “This is an operation which touched the entire country”.

The sale, he said, was part of the “economic inclusion” policy followed by the government. “The objective of HCB and of the government, which is the largest shareholder in the company, is to disperse the capital of HCB, so that Mozambicans become shareholders”, said Vala.

The sale was managed by the Mozambique Stock Exchange (BVM). BVM director Alcino Michaque said that this sale of over a billion shares was “a sovereign opportunity to popularize capital and to awaken the attention of investors”.

“We believe that the sale of part of the HCB shares will contribute to the economic empowerment of citizens and companies, creating an expanded base of new shareholders and investors , and awakening the attention of non-resident investors to the opportunities of the capital market in Mozambique”, he said.

The unit price of a share was three meticais (about 4.8 US cents at current exchange rates). Only Mozambican individuals, companies and institutions could buy the shares.

The hydro scheme has fixed contracted to supply 1,100 megawatt (MW) a year to South African electricity company Eskom, 300 to Eletricidade de Moçambique (EDM) and 50 to the Zambian state-owned power utility (Zeza).

Among recent highlights the board of directors presented was a 43% increase in revenue in 2018, following an agreement to increase prices for South Africa.

Prior to the sale Mozambique’s state owns 85% of the shares, the Portuguese power grid company (REN), 7.5% and the other 7.5% are treasury shares held by the company itself.

Author: Bryan Groenendaal