- Mozambique’s state owned news agency, AIM, reports The Coral Sul FLNG Project, a floating platform anchored in Area 4 of the Rovuma basin, off the coast of the northern Mozambican province of Cabo Delgado, has channelled 34 million dollars in revenue to the Mozambican state coffers.

However, according to a reliable source, cited by the independent newsheet “Carta de Moçambique”, the sum will not be used before the establishment of the Sovereign Wealth Fund, the law governing which has not yet been approved by the Assembly of the Republic (AR), the Mozambican Parliament.

The Sovereign Wealth Fund is an entity to be managed by the Bank of Mozambique and whose objective is to manage revenues from natural gas mega-projects.

“In truth, the 34 million dollars was the amount foreseen for the year 2022, but the source hinted that due to commissioning problems within the platform, registered in the initial months, production and exports were also affected”, writes the paper.

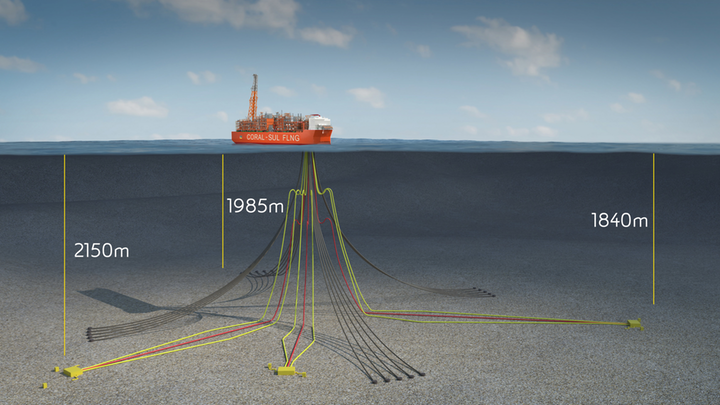

The Coral Sul gas extraction and liquefaction platform is the first in deep water, and the first project of its kind developed in Africa.

Image credit: ENI

The first shipment of natural gas was announced by President Filipe Nyusi on November 13, 2022, in a communication to the nation.

The floating natural gas liquefaction unit has the capacity to produce 3.37 million tonnes per year, using resources from the isolated Coral Sul reservoir.

The investment for this project is seven billion dollars, and it is expected to generate direct profits of 39.1 billion dollars, of which about 19.3 billion dollars will accrue to the State over 25 years from taxes, bonuses, fees, and profit sharing.

The members of the Rovuma Basin Area 4 consortium are Mozambique Rovuma Venture (MRV) S.p.A., which is a Joint Venture co-owned by Eni, ExxonMobil and CNODC of China with a 70 per cent participating interest, Mozambique’s own National Hydrocarbon Company (ENH) with a 10 per cent interest, Galp of Portugal and KOGAS of South Korea, each with 10 per cent.