Open-Ed

The solar manufacturing industry will consolidate in 2024, after oversupply and falling material costs drove a downstream price war in the second half of 2023. Smaller, tier-2 and tier-3 manufacturers with below-cost module prices will continue to face negative margins. Tier-1 Chinese manufacturers have also been affected by the crash in average selling prices and are trying to differentiate themselves from competitors with either innovative products or exceptional prices.

As a result, thin or negative margins will continue to make 2024 a challenging year for manufacturers, and the more-than 75% market share held by the 10 biggest polysilicon, wafer, cell, and module companies is set to grow.

Inventory issues

The least diversified solar distributors and installers are at risk because of price-fall-related write-offs in their extensive inventories, particularly in Europe. At the end of 2023, the total European module inventory exceeded that year’s installations. Despite the excess inventory in Europe over the last two years, there are no signs of a strong decline in shipments from mainland China in 2024.

Manufacturers and distributors are using strategies such as fire sales, reshipping, and longer payment terms to reduce inventory and help customers cope. A recent report from S&P Global Commodity Insights predicted that a normalization of module inventory in Europe will not happen before 2025.

Technology shift

Oversupply and thin manufacturer margins are forcing solar companies to accelerate product technology changes, such as from passivated emitter rear cell (PERC) to tunnel oxide passivated contact (TOPCon) panels. PERC technology will be phased out by 2025, with the exception of a few markets.

In 2024, two out of three modules shipped will be based on negatively-doped, “n-type” technology. The change from positively-doped, “p-type” to n-type shipments will happen faster in Europe as warehouses still have plenty of p-type imports from last year that are selling slowly. By contrast, n-type modules have a far better chance of selling at current price levels, due to their better performance.

Mind the gap

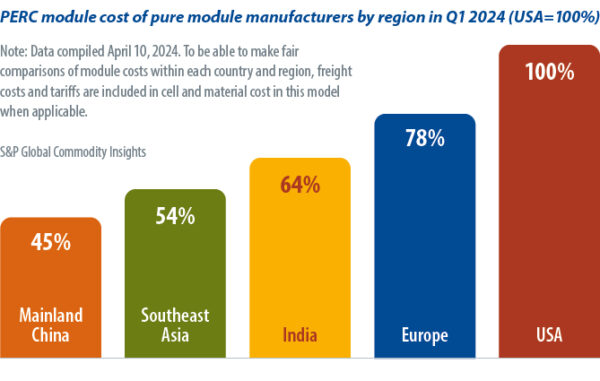

This new oversupply cycle has direct implications on policy efforts to reshore solar supply chains in the United States and Europe. After declines in module raw material costs, the production cost gap has only widened across regions. In the first quarter of 2024, average costs in mainland China were 45 – when indexing United States costs as 100 (see chart below). A year ago, Chinese costs were closer to costs in Europe and the United States, at 67.

It has become increasingly difficult and expensive to build manufacturing capacity in Western countries, jeopardizing ongoing localization efforts and the survival of existing local manufacturing bases. Incentives included in local-manufacturing packages, such as the US Inflation Reduction Act (IRA), might now prove insufficient to boost US domestic solar manufacturing capacity and the competitiveness of domestic players.

India has emerged as a country with competitive cost structures, allowing the subcontinent to lead solar manufacturing expansion outside mainland China. In addition to manufacturers attracted by production-linked incentives, new entrants are making modules, stimulated by opportunities to manufacture in India and ship to international markets, especially the United States.

The cost gap may not be the only challenge to reshoring policy. TOPCon is quickly becoming the dominant market technology and more than 90% of the market is based in China, where companies have invested in the approach for the last two years.

By contrast, most of the manufacturing capacity located in Western countries and India is PERC technology, which will soon be phased out. Upgrading older production lines or building new capacity entails large investment that many Western manufacturers will find very difficult. Ultimately, in this context, reshoring module manufacturing in the United States or Europe would be the easiest option if n-type cells can be imported.

These tough times will continue for Western solar manufacturers as bulging overcapacity in China shows no sign of abating, putting Western companies at risk of falling behind on technological development.

S&P Global Commodity Insights expects the global manufacturing base to continue growing at a faster pace than demand, and most of these expansions will occur in China. In the next two years, manufacturers will add 300 GW of annual solar module production capacity – the equivalent of more than 70% of total global demand during 2023.

How easily shipments from this massive new capacity reach international markets is something that remains to be seen. In 2024, the solar industry will face another global wave of policy in key markets including the United States, Europe, and India. Examples include the new foreign subsidy investigations opened by the European Union, the implementation of the restrictive Approved List of Models and Manufacturers for government projects in India; and in the United States, the end of an antidumping duty and countervailing duty moratorium, and the Uyghur Forced Labor Prevention Act.

Those moves will determine not only the fate of ongoing onshoring efforts in those regions but also the shape of global supply chains as they adapt to continue serving core markets.

Author: Edurne Zoco

This article was originally published in pv magazine and is republished with permission.

Disclaimer: The articles and videos expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Green Building Africa, pv magazine, our staff or our advertisers. The designations employed in this publication and the presentation of material therein do not imply the expression of any opinion whatsoever on the part Green Building Africa concerning the legal status of any country, area or territory or of its authorities.