- The Global Polysilicon Marker, the OPIS benchmark assessment for polysilicon produced outside of China, continued to hold steady at $30 per kg for a fourth week running.

- The fundamentals of this market, which have been characterized by limited availability and few spot deals, are still in place.

The prices of polysilicon vary greatly amongst different global producers; one producer claimed to be discussing prices of little more than $25/kg with its customers, but no agreements have yet been reached at this price. Another global provider is still providing pricing in the $35–36/kg area in the meanwhile. A source confirmed this week that Chinese enterprises are banding together for negotiations with the latter producer.

China Mono Grade, the OPIS’ assessment for polysilicon produced in China, is almost at its floor, notching down another 2.36% week to week to CNY62 ($8.54)/kg, its lowest figure in almost three years. Prices edge closer to the CNY60/kg mark, which is generally accepted to be the cost of producing polysilicon, indicating that there is no more room for sharp declines. As a result, the percentage decline for China Mono Grade fell into the single digits for the first time this month.

Oversupply concerns continue to be the main theme of the story about polysilicon in China, and multiple contacts concurred. One source estimated that China’s tier-1 manufacturers now sit on around 80,000 MT of the material, while another source put China’s total polysilicon stockpiles at more than 100,000 MT.

However, one source pointed out that the new manufacturing capacity, which was supposed to be released in June, has been delayed. The insider said it is better “to delay production and stay on the sidelines” because these facilities have significant manufacturing expenses and will incur losses if they produce polysilicon in the current low-cost market.

There has been a glimmer of calm in the downstream business as a result of the pricing of China Mono Grade becoming less volatile this week. Wafers prices have also stabilized for the first time after falling for more than two months. The Chinese Module Marker, the OPIS benchmark assessment for modules from China, held steady at $0.173 per W this week after four weeks of plunging prices. Looking ahead, OPIS believes that the production costs of the supply chain are no longer the decisive factor in pricing, and the ensuing changes in demand will have a significant impact on the prices of each manufacturing segment.

Solar panel prices dip

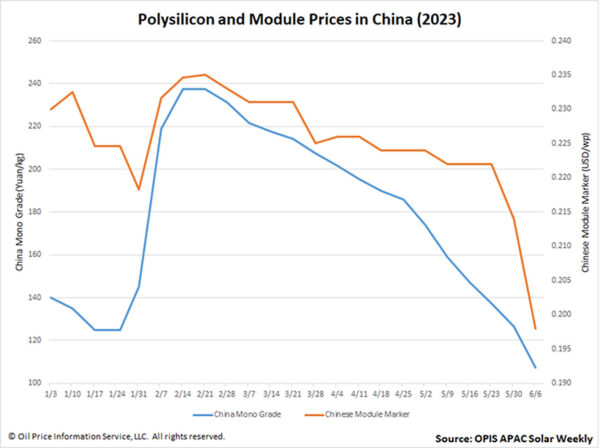

The Chinese Module Marker (CMM), OPIS’ benchmark assessment for solar panels from China, declined for a second week running last month to USD 0.198 ($0.29) per W as dramatic downslides in the country’s upstream segments pushed module prices to their lowest level in almost three years, according to OPIS data.

This 7.48% plummet – the largest percentage drop so far this year – takes CMM below the psychologically significant level of USD 0.2/W ($0.3/W).

Multiple market players pinned the slump on growing polysilicon capacity in China and how China-made polysilicon is essentially back at what one source calls a “reasonable price.” The latter, which OPIS assesses as China Mono Grade, continued its inexorable march downwards to CNY 107.5 ($22.33)/kg.

China module prices are dropping rapidly, with opening bids for some recent domestic projects all lower than CNY1.5/W, noted multiple sources. Downstream demand is huge, with 48.31 GW installed in the first four months of this year. Yet module shipments are still lower than expected as prospective buyers, expecting further price drops, delay their purchases, sources also concurred. Buyers will wait as long as their project allows them to do so, explained one veteran market observer, adding that he did not expect falling module prices to level off.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

This article was originally published in pv magazine and is republished with permission.