- South Africa’s coal-heavy power system will transform rapidly even in an economics-led scenario, new BNEF modelling finds.

- The country needs an average of $5.9 billion of investment in power generation per year from 2021 to 2040, to deliver on the cheapest capacity mix to replace its retiring coal fleet.

A BloombergNEF study shows that South Africa cannot escape the need to spend significantly on new wind and solar power plants. Under a range of scenarios considered by researchers the country may need to spend as much US$136 billion on new power generation capacity over the next two decades. A slowing down of the proposed closing of coal-fired plants wouldn’t negate the need for renewable energy the study finds.

Solar boom incoming, cutting coal output

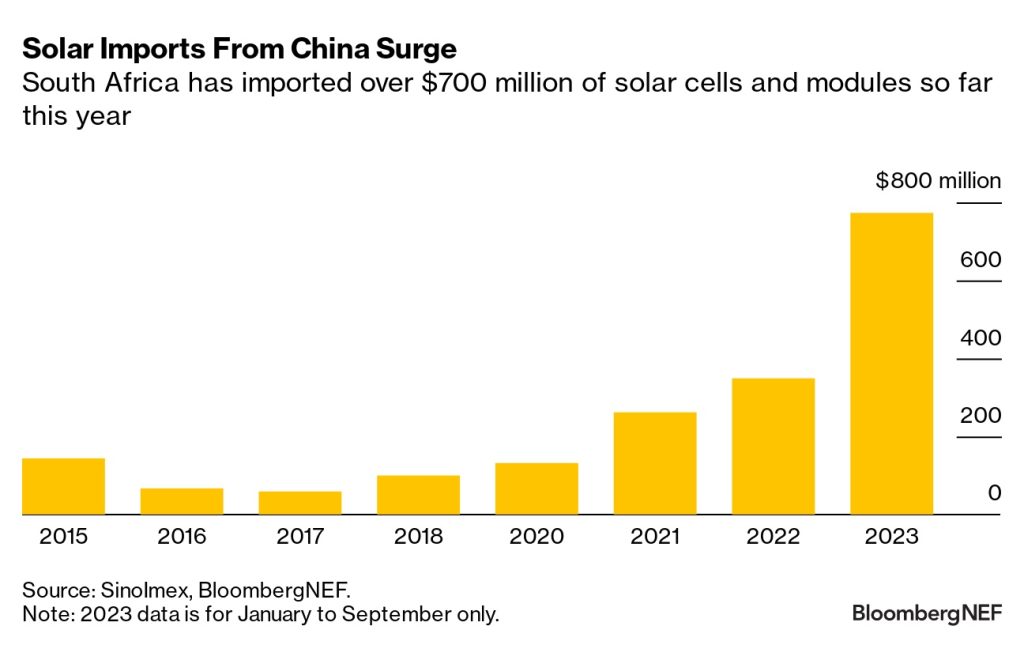

Small-scale solar installations are booming in South Africa amid rolling power cuts and regulatory changes. Export data for solar products from China surged in 2023, with $770 million directed to South Africa in the first half alone.

Despite a slowdown in exports since July, BNEF expects over 3.5 gigawatts of residential and commercial solar to be added annually from 2023 to at least 2025, or until the electricity supply crisis ends.

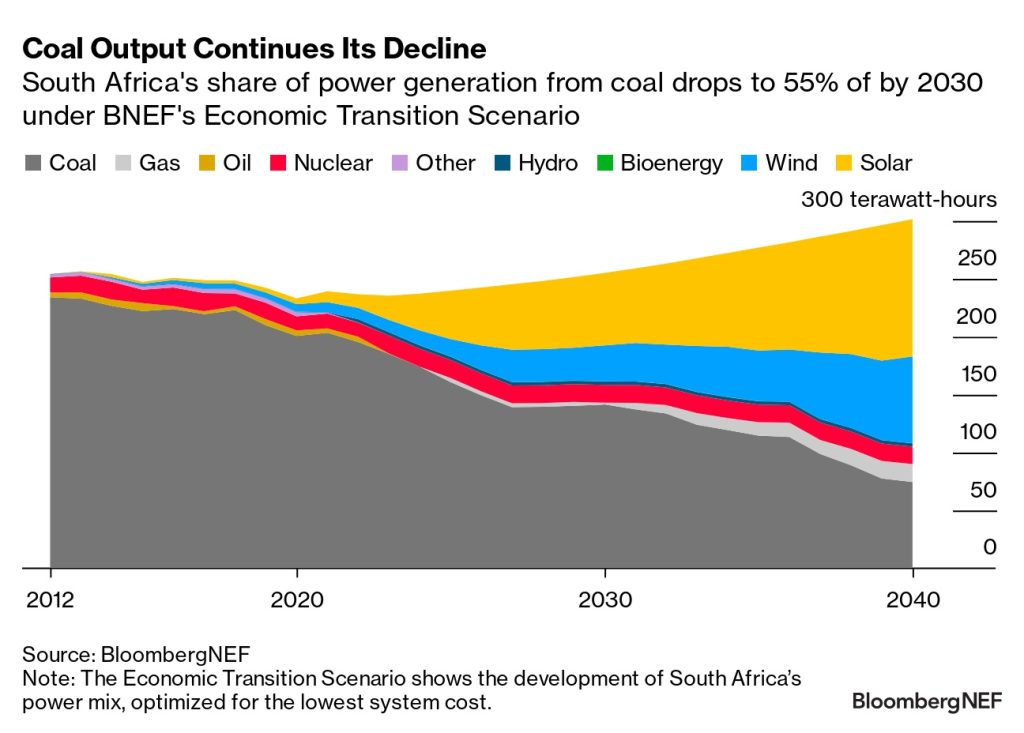

The deployment of 36 gigawatts of new wind and solar by 2030, under BloombergNEF’s economics-led scenario, means that renewables grow to supply over a third of South Africa’s power mix. This lowers demand for coal generation by 28% by 2030 from 2021 levels, and cuts emissions produced by the coal-heavy grid by almost a third.

During the 2030s, new-build solar becomes cheaper than running even the most efficient coal units, driving installations further. Renewables, primarily wind and solar, supply two thirds of South Africa’s electricity mix by 2040.

New generators can ease coal retirements

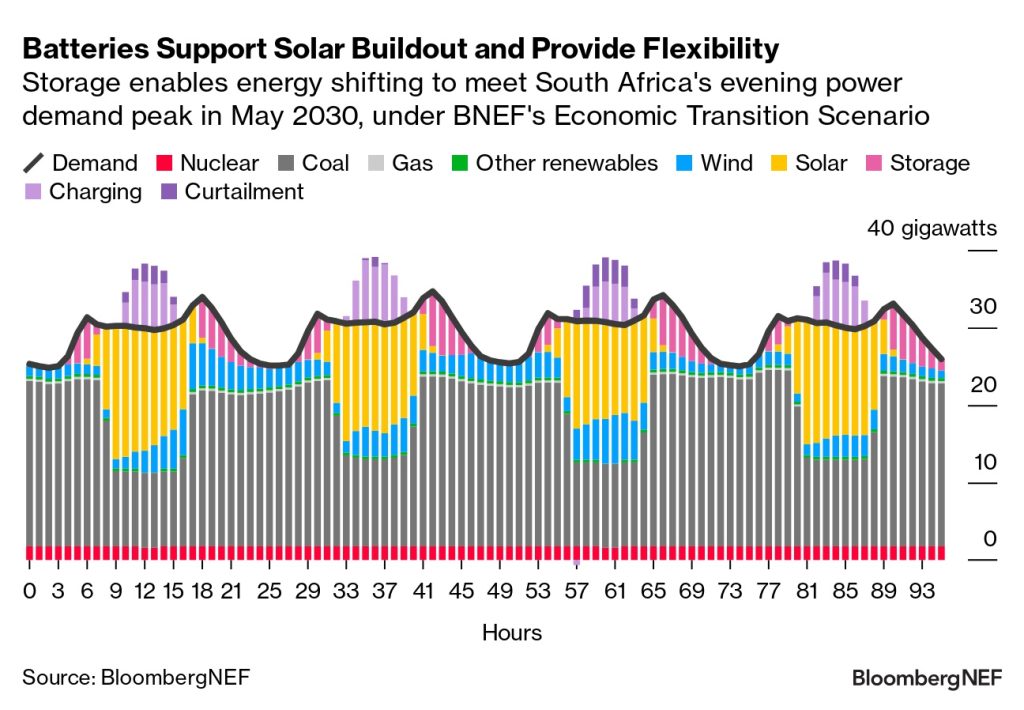

Battery storage and flexible gas plants are the most cost-efficient solution to complement growth in solar and wind generation and guarantee supply. The fleet of batteries and gas plants reach a cumulative 37 gigawatts by 2040, almost the size of today’s coal fleet.

Alongside remaining coal plants, gas plants support the system during times when output from renewable energy is low, while batteries shift solar generation to other parts of the day.

Where South Africa is now

Around 81% of South Africa’s energy needs are directly derived from coal and 81% of all coal consumed domestically goes towards electricity production. Historically this has given South Africa access to cheap electricity, but it is also one of the leading reasons that the country is in the top 20 list of carbon dioxide emitting countries.

Eskom’s 14 coal-fired power plants, with an average age of 41 years, are designed to deliver 38.7 GW of the country’s 52.5 GW installed capacity. The coal plants continue to fail to meet the country’s energy demand.

Eskom’s generating plant availability reached the lowest levels ever in the 2022/23 financial year, due to unprecedented levels of unplanned unavailability from coal and nuclear power.

Another factor that contributed to the supply constraints is the fact that IPP capacity – both renewable and other programmes, such as DMRE’s Risk Mitigation IPP Procurement Programme – has not come online as expected under the IRP 2019, with an energy shortfall of more than 5 100GWh for the year, requiring increased levels of loadshedding and “overproduction” by Eskom and IPP-owned OCGTs of around 2 000GWh for the year.

Related news: South Africa’s energy procurement programme is in tatters

Additional dispatchable capacity of 4 000MW–6 000MW is required immediately, to support the stability of the power system, create space for maintenance and reduce the need for loadshedding (blackouts).

The South Africa Power Transition Outlook was produced by BloombergNEF in partnership with Bloomberg Philanthropies. Read the full report here.

Report Author: Emma Champion, Head of Regional Energy Transitions, BloombergNEF

Author: Bryan Groenendaal