- The African Development Bank has released its Project Completion Report on South Africa’s 4764MW Medupi Power Project.

- Due to current perceptions of coal energy this plant is unlikely to reach its original projected 50-year life and hence may not be as cost effective in the long term as originally expected.

- Choice of mega projects with such long lives needs very careful consideration to avoid the challenges now faced by this project in terms of cost and time overruns as well as climate change related environmental concerns.

Medupi’s availability is seriously impacted by latent defects and this to lower availability has significantly reduced its return on investment. The project delivered the outputs required of 6 boilers and turbines but Eskom is still to establish optimal performance from the plant. The practice of using virtual designs should be avoided since designs need to be adapted to local coal quality, ash content and related conditions effectively or else such defects will be to the detriment of plant performance.

If the installed fleet could have been adequately maintained during the construction of Medupi, there would most likely have been an increase in reserve margin and an end to load shedding at commissioning of Medupi Power Project. However, given the lack of reliability maintenance on the older generation plants, this fleet may be stuck in a poor and deteriorating performance cycle. Examples of the impact due to lack of maintenance include.

- Fleet efficiency reduced from 33.1% in 2009 to 30.61% in 2021 even though Medupi has an efficiency of approximately 36%.

- Fleet water consumption increased from 1.34 to 1.42 litres per unit sent out, partly because of deteriorating efficiency mentioned above.

Image credit: AfDB

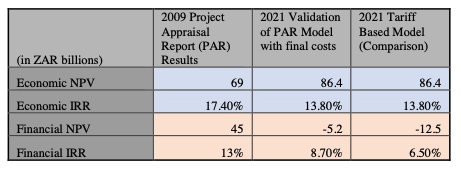

“The analysis of cost benefit shows that the Medupi project as installed will not show a positive return and will deliver internal rates of return below the weighted average cost of capital for Eskom in terms of the financial model. Therefore, it is concluded that this project will not show a financial benefit over its lifetime,” the report concluded.

Link to the full report HERE

Author: Bryan Groenendaal