- Mobisol, the Berlin-based pioneer in solar-home systems for rural electrification, recently filed for preliminary insolvency proceedings under self-administration.

- Mobisol’s insolvency will raise concerns for many investors who are already invested in rural electrification companies or are considering investments.

The insolvency raises questions about the viability of business models in rural electrification. Even though there were some rumours about the economic challenges that Mobisol was facing, the German company was generally considered as one of the stars in the rural electrification community.

The aim of the self-administered insolvency is to allow the successful restructuring of the company and to bring the negotiations with new investors that began at the start of the year to a successful conclusion.

Since 2013, Mobisol has supplied more than 600,000 people in remote parts of Africa with solar electricity. The company also seemed to outperform most of its competitors regarding access to capital and was backed by highly regarded financiers including KfW/DEG, Finnfund, Investec Asset Management (Africa Private Equity), FMO, and IFC.

This is not only true for rural electrification with solar-home systems but also for access-to-energy solutions with mini-grids — as mini-grid developers have the disadvantage that they cannot fish for the wealthiest clients in target areas but have to deal with the realities in a particular village. They need to find enough off-takers around a centralised solar-power plant that can actually afford to pay for electricity.

This is not only true for rural electrification with solar-home systems but also for access-to-energy solutions with mini-grids — as mini-grid developers have the disadvantage that they cannot fish for the wealthiest clients in target areas but have to deal with the realities in a particular village. They need to find enough off-takers around a centralised solar-power plant that can actually afford to pay for electricity.

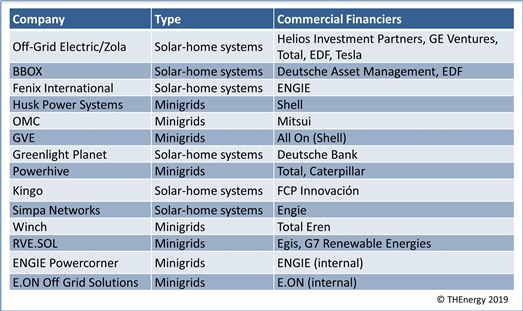

Examples of commercial investors backing rural electrification companies

However, Mobisol is different from some of its peers in rural electrification. Companies like Off-Grid Electric, Fenix International, BBOX, Greenlight Planet, Husk Power Systems, Powerhive, Kingo, Simpa Networks, OMC, Winch, GVE, or RVE.SOL does not completely rely on impact investors such as DFIs but has also managed to acquire private financiers with mainly commercial interests such as Engie, Shell, EDF, Total, Caterpillar, Mitsui, Deutsche Asset Management, Deutsche Bank, Helios Investment Partners, FCP Innovación, or EGIS.

At first sight, the involvement of private investors seems to restrict rural electrification companies in their freedom. Sometimes requirements of a start-up are not compatible with the processes of larger organisations. Nevertheless, private investors often manage to focus energy-access start-ups more on business aspects such as process efficiency, cost awareness and control, purchase, sales/marketing excellence and controlling. Managing hundreds of thousands of customers is a highly complex task which requires new skills from start-ups.

THEnergy, a boutique consultancy founded in 2013 focusing on microgrids/mini-grids and off-grid renewable energy, has gained deep insight into the rural electrification process through two due diligence as a lead consultancy and various other consulting projects. “We are convinced that private start-ups are much more efficient than most of the local utilities in electrifying rural areas in developing countries,” says Thomas Hillig, managing director of THEnergy.

Access-to-energy start-ups typically come with excellent engineering capabilities, extreme commitment throughout the whole organisation, and high ethical standards. However, from a business perspective, they can often need assistance. Hillig adds: “THEnergy is so successful in this segment, because we combine off-grid experience with business skills. Private investors are more used to working with external consultants and see the particular value of process optimisation, functioning IT-systems and a sophisticated scheme of key performance indicators (KPIs) – just to give some examples from our daily consulting business.”

Author: Nicolette Pombo-van Zyl

This article was originally published on ESI Africa and is republished with permission with minor editorial changes.

1 Comment

The challenge is that the company does not seem to have had the cultural insight to rural African communities. Solar energy alone does not create jobs and disposable income for the end user. One needs to implement complete holistic solutions, with buy in of the community and their local leaders. We do this for the past 15 years in Southern Africa using our low cost fuel cell hybrid solar energy to create energy reliable 24/7 that can address the needs of deep rural communities.